Customer Lifecycle Research: How to Gain Consumer Insights at the Awareness Stage

KEY TAKEAWAYS:

- To remain competitive, brands must learn to understand consumers at every stage of the customer lifecycle, especially the awareness stage.

- At the awareness stage, consumers are looking for information related to the challenges they’re facing or the potential opportunities they anticipate. In other words, the consumer may be problem-aware, but not solution-aware or product-aware at this stage.

- The right mix of marketing content, quantitative analytics, and qualitative analytics gives brands the tools they need to truly understand consumers in the awareness stage.

In the customer lifecycle, awareness is the first stage wherein buyers identify a challenge or a possibility they want to pursue. By leveraging the right qualitative and quantitative research methods in the awareness stage, brands and sellers can use this window of opportunity as a source of great consumer insights as well.

What Consumers Want in the Awareness Stage

When a need emerges, consumers may start their inquiry process by browsing the internet, perusing social media, or talking with family, peers, or business associates about the challenge they’re trying to solve. At this stage in the customer lifecycle, they want information rather than a push for purchase. And they want to get this information without committing to any specific website or signing up for content that would require them to enter personal information. According to Hubspot, a large marketing software vendor, only 19% of potential buyers want to connect with a salesperson during the awareness stage of the customer journey.

If consumers are reluctant to talk to salespeople in the awareness stage, how can companies find actionable consumer insights? The answer lies in clearly identifying key audience personas, recruiting them to a panel, and asking them about the types of problems they might experience, what they think about different brands, where they go to learn about solutions to their problems, and so on. Understanding the behaviors of buyers in the awareness stage helps brands develop the right approach to both marketing and consumer research.

What Brands Must Do to Understand Their Consumers Early in the Journey

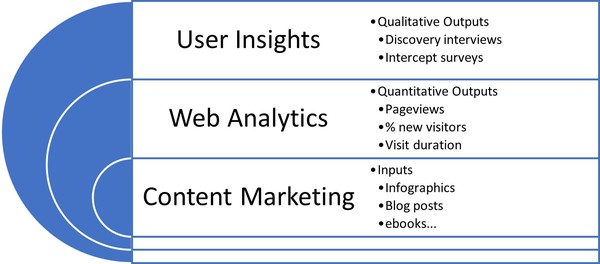

True consumer insights result from an iterative process that involves providing the right content marketing materials to address consumer concerns at the awareness stage, capturing web analytics for quantitative research into consumer online behaviors, and performing qualitative research to delve into the motivations and emotions behind consumer behaviors.

Awareness Stage: User Insights Conduit

Content Coupled with Consumer Research Provide Key Insights

In the awareness stage, the online customer journey and behavior are driven by marketing rather than sales. Marketing content that resonates with consumers can help identify their persona and wants and needs, which will help brands refine both the sales funnel and the buyer’s journey. For the awareness stage, the website should be populated with infographics, blog posts, and ebooks that address common challenges consumers are facing, along with content that reveals how brand offerings can mitigate those challenges. One caveat to remember, however, is that, for the awareness stage, in particular, content should not be overly promotional, as consumers in this stage are not yet ready for a strong sales pitch.

Once consumers begin interacting with content on the website, website analytics can be used to further identify buyer personas and optimize web content accordingly. Similarly, social media analytics can be used to mine additional consumer information to enrich personas and add layers of nuance to the marketing message that brands craft for their target audiences.

In addition to these quantitative analytics, qualitative analytics plays a significant role in the awareness stage. For instance, many brands use website intercept surveys to target visitors, understand their intent, and collect feedback to evaluate their online experience. For even more insights, live conversations with consumers at this stage give brands greater depth and breadth of understanding.

To get the most actionable insights from conversations, brands must carefully consider the questions to ask. Rather than asking generic questions such as, “What brings you to the site today?” it is better to ask specific questions pertaining to consumer intent. For example, for a B2B brand that sells ERP software, the question might be phrased as “What is your biggest accounting challenge right now?”

Allowing open responses to questions gives brands a greater depth of consumer insights to mine and helps them flesh out their personas more fully. Live conversations allow brands to probe and clarify responses to get deeper understanding of consumer sentiment.

_600x.jpg)

Discovery interviews are also key ways to tap into the minds of consumers in the awareness stage of the customer lifecycle. Conversations with potential customers help brands respond to key questions. Well-designed discussion guides help moderators focus interviews around the specific research questions the brand has identified as important, such as what problems the consumer is trying to solve, what steps the consumer has taken to solve the problem, what other solutions the consumer has considered, and so on. Discussions can be conducted through focus groups or in-depth interviews (IDIs). Focus groups may be more effective in the early awareness stage, but IDIs tend to lead to greater volumes of qualitative data overall.

Recruitment of discussion participants is not usually difficult at the awareness stage as people are often happy to talk about their aspirations and frustrations, especially when they feel they are part of the process to find a solution.

Discuss.io Makes Online Qualitative Research Easy

Discuss.io is an online qualitative research platform that makes it quick and easy for you to find global consumers, conduct video interviews, and capture and share insights across your organization.

Purpose-built for market research, Discuss.io includes tools to organize, analyze, and present your research. From discussion guides that appear right in the video meeting room at the moderator’s fingertips to the ability to quickly bookmark and index important moments in interviews to share collaboratively with your team, Discuss.io has a variety of tools built to help you slice and dice your data to surface patterns and discern real consumer insights quickly across high volumes of interviews.

Get a free demo to discover how you can connect with more customers, analyze your data faster, and gain actionable consumer insights at scale.

Sign Up for our Newsletter

Related Articles

From Observation to Insight to Strategy: The Evolution of Innovation

Many people think that innovation starts with the proverbial “big idea,” the imaginary bulb that lights up above an inventor’s…

Many people think that innovation starts with the proverbial “big idea,” the imaginary bulb that lights up above an inventor’s…

Get Pinpoint Accurate Personas Using Qualitative Research

Whether you need to understand a user base for a go-to-market strategy or are looking to build customer awareness across…

Whether you need to understand a user base for a go-to-market strategy or are looking to build customer awareness across…

Beyond NPS: Understanding Customer Satisfaction with Qualitative Research

A net promoter score (NPS) is highly valuable when it comes to measuring overall customer loyalty and satisfaction, in turn…

A net promoter score (NPS) is highly valuable when it comes to measuring overall customer loyalty and satisfaction, in turn…