Agile Approaches to Consumer Insights

Think about organizations that are able to adapt to change most rapidly — chances are, they’re all tech companies. It may seem obvious, as these organizations are in the business of innovation, yet we don’t often take a step back and think about how agile research methodologies have paved the path to innovation.

For years, the tech sector has employed agile market research methods as a standard approach for product development, allowing user and customer feedback to insert itself into all stages of that development cycle. This has held the key to unlocking excellent customer and user experiences. Incorporating a “test and learn” mindset clearly pays off, as continuous improvement keeps upping the game in delighting end users.

Given the modern expectations of innovation, speed, and quality, and the benefits of an agile research approach, it is not surprising that teams outside of product development, like marketing and customer experience (CX), have started to adopt agile methodologies as well.

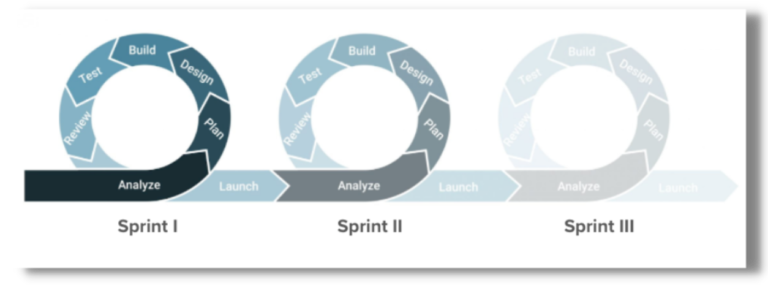

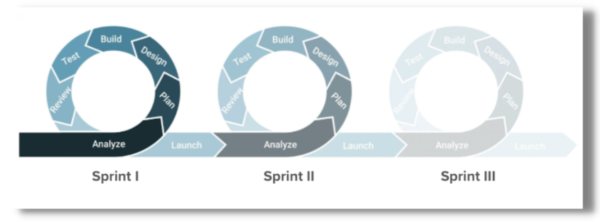

Agile market research provides unlimited flexibility compared to traditional research methodologies. Instead of following a linear path, agile methods focus on conducting research in short waves or sprints. This provides a dedicated place for teams to pause, incorporate feedback, and iterate.

Agile Qualitative Research

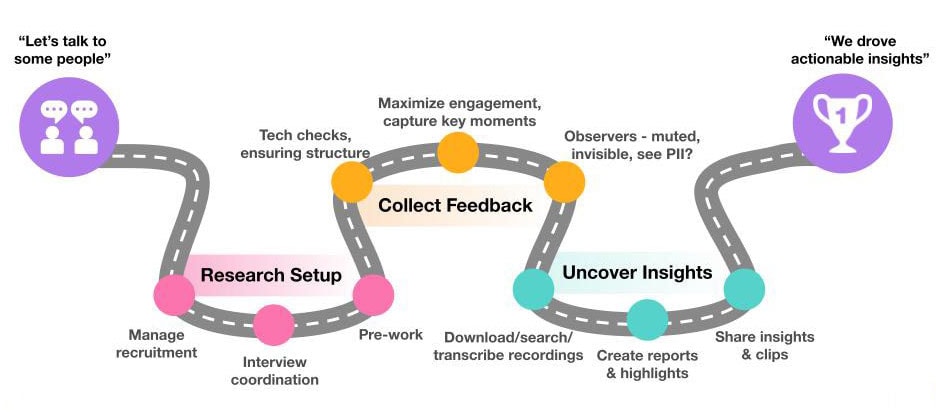

Agile qualitative research methods imply that a customer feedback loop is baked in to the research process, leveraging the voice of the consumer (VoC) to provide directional guidance. In addition, CX, UX, and insights teams cite their ability to include stakeholders in this process as among the most helpful parts of development and iteration.

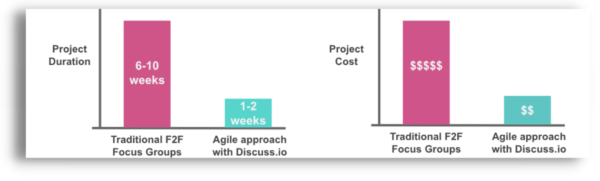

Because traditional methods are conducted in person, this type of research is often expensive and time consuming to conduct. Typically, in order to reduce the costs associated with research facilities and travel, companies can spend weeks crafting the “perfect” moderation guides, cram all of their research into 1-2 days, and then leave the analysis for when they return to the office. However, this leaves little room to adapt the research according to what is and is not working, sometimes resulting in fewer valuable insights.

We have witnessed some of our clients successfully implement agile methodology with their research approach with clear results. The insights team at one multinational corporation in particular was able to insert research cycles early and often into their innovation process, resulting in the confident launch of a new product a full fiscal quarter early, exceeding expectations.

Their playbook went a little something like this:

Leveraging Discuss’ People Experience Platform and incorporating 2-week agile research sprints within their innovation process, they received consumers’ feedback throughout the project. Each sprint began with 3-4 days of recruiting to locate the target audience. Over the next few days, the insights team participated in 7-9 sessions with consumers. Digital whiteboard and marking tools were then used to show designs and encourage detailed feedback.

Findings were then aggregated and a simple report was developed within 48 hours with the help of our online suite of consumer insight extraction tools, Augmented Insights.

The report was then shared with all stakeholders, ensuring that all were informed and accountable. From there, the insights team determined the right changes and questions for the next round of iteration. This cycle spanned a period of about 2 weeks, then was repeated in 5-7 waves.

Using an agile approach to qualitative research, the insights and innovation teams were able to collaborate seamlessly and incorporate consumer feedback throughout the process. Should they have taken this approach using traditional in-person methods, each of these 5-7 waves would have taken 4-8 weeks as opposed to 2 weeks per wave when leveraging online tools.

Due to these shorter cycles, they were also able to drive innovation into their recruiting approach. During each wave, they identified “super-users,” or people that provided insightful feedback. Toward the end of the project, they invited all of the “super-users” to participate in one session together. As a final validation, they wanted to ensure not to lose their loyal following (i.e. the “super-users”) by introducing a new product category to the brand.

This example is one of many that outlines how new tech and online tools can enable an agile approach to qualitative research — proving it is now possible for brands to run multi-wave projects in real-time to quickly gain feedback at multiple key milestones in their process.

An agile approach to qualitative research allows knowledge gained through previous waves to be utilized and built upon, thereby optimizing results with each iteration and resulting in better products and shorter time-to-market.

The Discuss Difference

We never tire of hearing from customers when they’ve reduced their time-to-marketing in as much as one full fiscal quarter with the help of our People Experience Platform.

One client that has seen success in our agile approach is Sai Pisipati, Global Insights and Analytics Manager at Reckitt, who explains: “If I do traditional research for a focus group project it can easily cost me $50k-$60k on top of a lot of work and diligence. Discuss cuts our research time in half, decreases our costs by 75% and adds another layer of richness to our research.”

To learn more about agile methodologies for qualitative research, download the ebook: “Principles of building a World-Class Agile Qualitative Research Program.”

Sign Up for our Newsletter

Related Articles

3 Key Takeaways from “Rethinking the Agile Manifesto for Research” Webcast

In the recent webcast, “Rethinking the Agile Manifesto for Research – And How to Put Experience at the Center,” Forrester…

In the recent webcast, “Rethinking the Agile Manifesto for Research – And How to Put Experience at the Center,” Forrester…

What is Asynchronous Video?

Asynchra–wha? Asynchra–who? What is Asynchronous Video? Basically, it includes any video-based recording that is not live-streamed or happening in real-time,…

Asynchra–wha? Asynchra–who? What is Asynchronous Video? Basically, it includes any video-based recording that is not live-streamed or happening in real-time,…

Start a Self Captures Free Trial in 3 Easy Steps

Self captured experiences are a critical component of understanding customers with context rich and scalable insights. That’s why Discuss launched…

Self captured experiences are a critical component of understanding customers with context rich and scalable insights. That’s why Discuss launched…